Finance Department

A Piece of the Pie

The City’s piece of the pie.

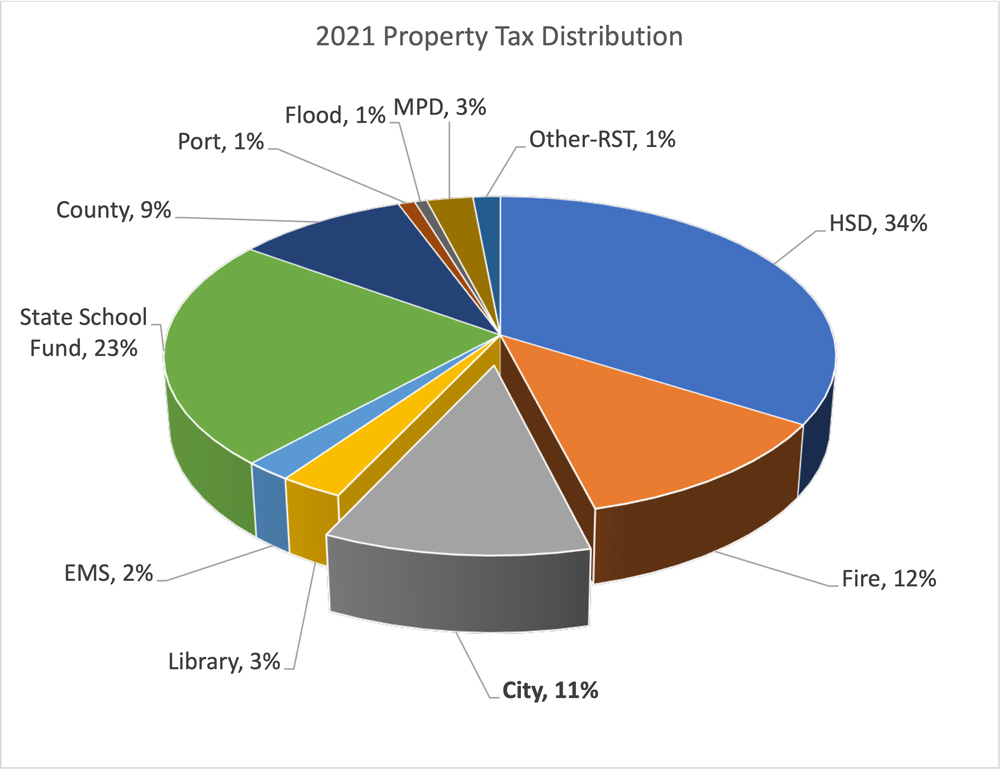

As a homeowner, one of your largest expenses may be your annual property tax bill, which makes it important that you understand where your dollars are going. Property owners may think the total property tax bill is collected by the City where they reside. This is only partially true.

A home valued at $500,000 will have a property tax bill as follows:

| Estimated Home Value | $500,000.00 |

| Per $1000 Assessed Value | 500.00 |

| Total Levy Rate | $13.26 |

| Total Prop Tax Bill | $6,629.61 |

| 11% to City of Normandy Park | $730.60 |

| 89% to Other Taxing Districts | $5,899.02 |

A large portion, 89% or $5,899.02, is distributed to other taxing districts like Highline School District, State School Fund, or Fire District. The City’s piece of the pie is the remaining 11% or $730.60, which is distributed to the City of Normandy Park used to provide services to the City, which include police, permitting, facilities maintenance, community development, and other functions like administration, finance, and clerk support services.

“As a homeowner…”

Jennifer Ferrer-Santa Ines, Finance Director

City of Normandy Park

801 SW 174th Street

Normandy Park, WA 98166

(206) 248-8251 (Direct Phone)

Public Hearing – Metropolitan Parks District Property Tax Levy

The Metropolitain Parks District Board will hold a public hearing to hear from residents on the proposed 2024 Property Tax Levy Resolution No. 2304. Additional information of the resolution can be found on the city website. Comments for the hearing will be taken in person at City Hall, 801 174th Street, Normandy Park, and remotely using Zoom. Please see the meeting agenda for instructions on how to provide comments.

City Council Starts Review of the 2023-2024 Budget

On Tuesday, October 25th, the City Council reviewed the proposed Preliminary Budget for 2023-2024. This is an important document since it presents the overall plan for allocating City resources on the variety of programs necessary to provide for public safety, enhance the quality of life and natural resources, and maintain and develop the City’s facilities and infrastructure. We are committed to providing the highest quality municipal services possible with the limited resources available.

Public Hearing Notice – 2023 Property Tax Levy & Revenue Sources – Metropolitan Parks District

The Park District Board of the Normandy Park Metropolitan Park District invites all interested parties to attend the Public Hearing on Tuesday, November 8, 2022, beginning at 6:30 pm in person at City Hall, 801 SW 1745th Street, Normandy Park, WA 98166, or via Zoom, to consider the following: A resolution of the Park District Board increasing the regular property tax levy to a rate not to exceed $.29/$1,000 AV commencing January 1, 2023, on all property, both real and personal, in compliance with the RCW 84.55.120